0x057

web3 is showing signs of life as centralised banking is loosing trust, bitcoin decouples from its Nasdaq correlation, the tokenproof wallet and the EU Web3 VC landscape.

Tons happened in web3 last week. Here are the top highlights:

This week’s dose of web3 is a holistic kickoff into 2023 ↓

a twitter tweet & thread¹

worthy reads²

1. tokenproof’s new Coinbase-powered wallet is newcomers’ key to web3

“…To create a tokenproof wallet, all users will need is an email address. Rather than jumping through hoops to learn complicated terminology and complex concepts before creating a wallet and entering the space, users can now participate in online and real-world token-based experiences regardless of their initial familiarity with crypto. The days of worrying about remembering lengthy seed phrases or risk losing prized collectibles are over; wallets can be backed up to the cloud for easy and safe recovery. Without having to worry about navigating new technology or being on high-alert for safety risks, the tokenproof wallet lets people make the most of their web3 experience as soon as they join. With this new feature, users will have a wallet ready to go that will allow them to participate in the kinds of on-chain experiences tokenproof has become prominent for powering since its launch. For instance, traditional consumers will be able to join crypto-natives in unlocking interactive experiences that only require a wallet and either tapping on an NFC tag or scanning a QR code…”

Read the full article here by @FonzGm.

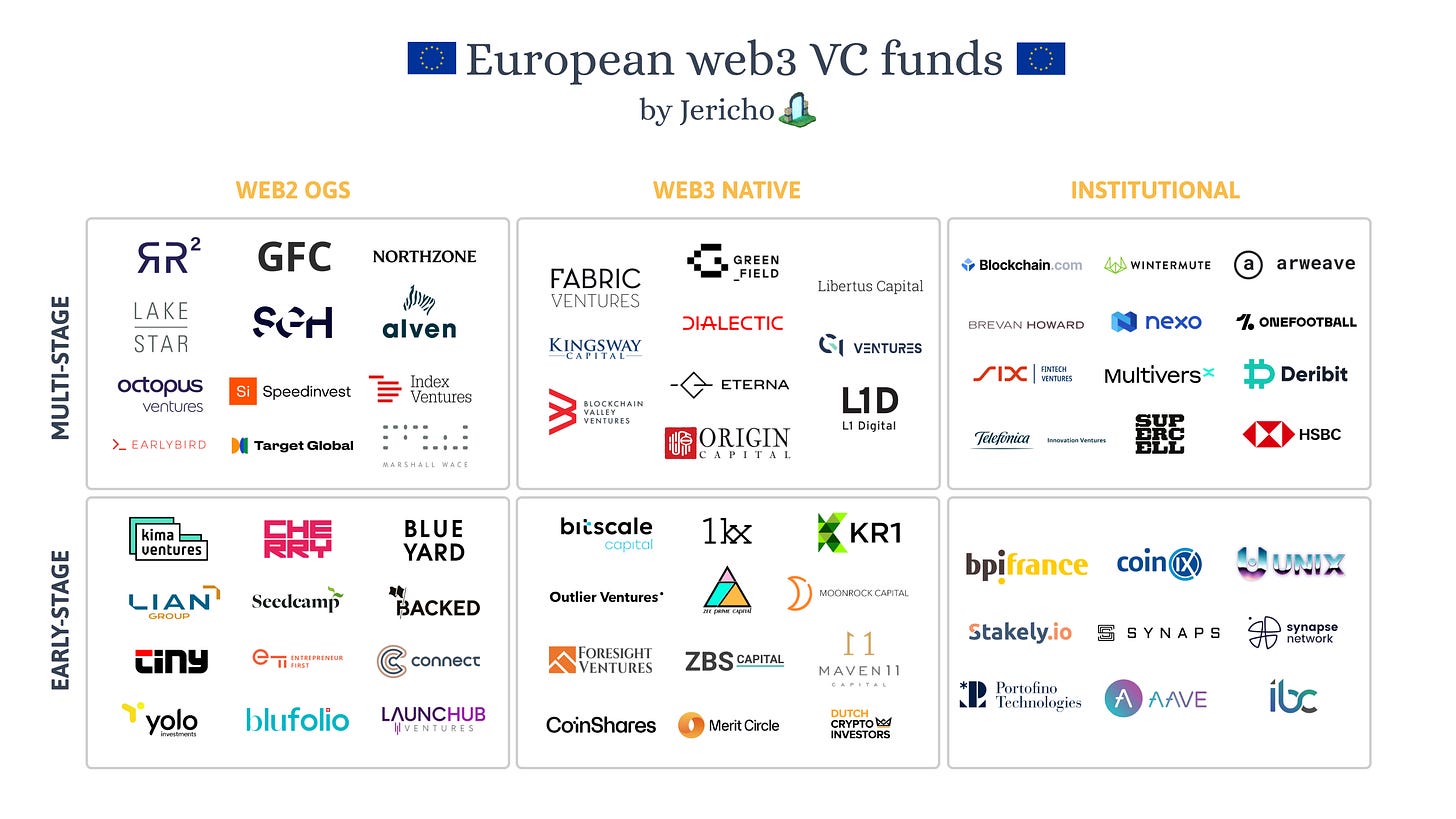

2. 🇪🇺 European web3 VC landscape

“…We gathered data from 170+ European web3 VC funds using their websites and Crunchbase profiles. We qualified the funds using the following fields: Fund type: Is the fund web3 native, is it a web2 fund investing in web3, or is it a web3 company’s venture arm? Investment stage: Does it mainly invest in early stages (pre-seed, seed), across stages, or only in later stages (Series A & above)? Vertical: Infrastructure, Exchanges, DeFi, NFT, DAO, Gaming. Web3 investments: The number of web3 companies they’ve invested in. Lead ratio: The percentage of investments where the fund led the round. Investments include: 3 examples of companies they’ve invested in. You can find the full list of funds here. Feel free to download the CSV for your use. The mapping is based on two factors: Is the fund investing early-stage or across stages? We removed the late-stage-only funds because there weren’t many of them. Plus, web3 is a relatively young industry where early-stage capital is needed more than growth capital. What is the fund type (Web3 native, Web2 OGs, Institutional)?...”

Read the full article here by @0xvladimir.

undiscovered products³

Tokenproof → connect with your audience through token-based experiences, both online and IRL.

Bowline → make your NFT Collection thrive with in-browser software tooling.

Peanut → forget about wallet addresses & transactions. Simply send a link.

Find these and all 480+ other resources on intoweb3.land ↗.

↻ a summary

W10 includes updates on the EU Parliament's smart contract regulation, daily layer 2 transaction count, UK's new crypto tax rules, and Microsoft's testing of a crypto wallet. Additionally, it features two reads: one discussing a new tokenproof wallet that simplifies crypto for users, and the other providing insights on the web3 venture capital landscape in Europe. Lastly, the newsletter highlights three undiscovered products, including Tokenproof, Bowline, and Peanut, that offer innovative solutions for token-based experiences, NFT collections, and simplified transactions.

☞ share the good news ☜

If you liked this newsletter, why not forward a friend?

intoweb3.land is curated by Julian Paul.

See you around.