0x049

web3 continues to pick up momentum with fresh innovation, how to think about fees on protocols vs. companies and why to regulate web3 apps not protocols.

Tons happened in web3 last week. Here are three highlights:

This week’s dose of web3 is a holistic kickoff into 2023 ↓

a twitter thread¹

worthy reads²

1. Regulate Web3 Apps, Not Protocols PART II

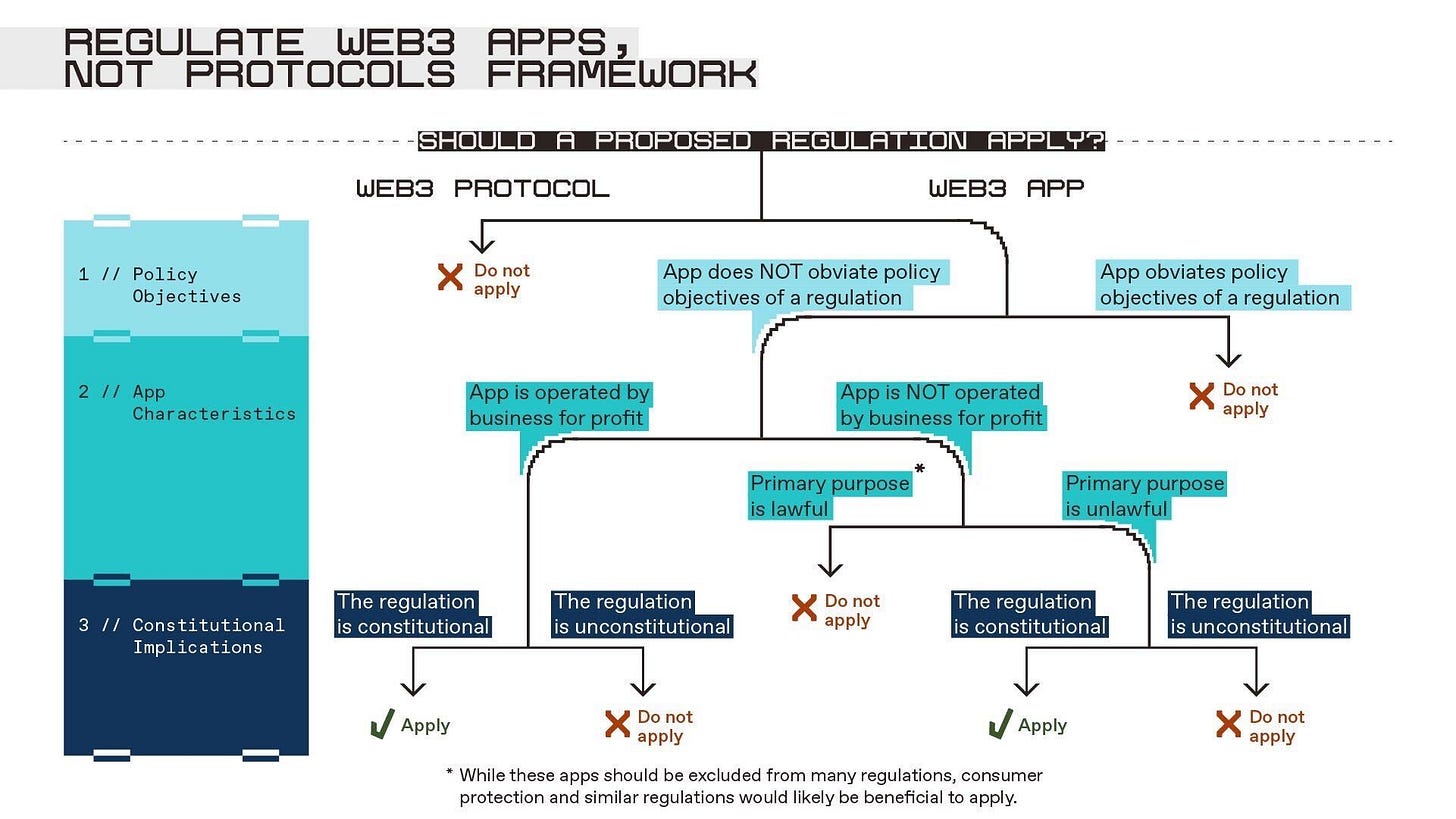

“…While the propagation of web3 technology adds a layer of complexity to the challenge of regulating the Internet, a web3 app regulatory framework does not need to address illicit activity at the protocol level. We do not regulate SMTP just because email can facilitate illicit activity. But proposals for web3 regulatory frameworks must be capable of accomplishing policy objectives by reducing the risk of illicit activity, providing strong consumer protection and removing incentives that run counter to policy objectives — this can be done most effectively at the app level. We believe such a framework for the regulation of web3 apps should focus on three interrelated factors: First, the policy objectives of an intended regulation must be assessed. If the regulation won’t accomplish a legitimate goal, it shouldn’t be adopted. Next, the characteristics of the apps to be regulated must be considered. Web3 apps work in many different ways, which should directly impact the scope of regulation. Finally, the constitutional implications of a given regulation must be analyzed. Granular, fact-based analysis that can inform regulatory activity and judicial opinion should accompany any web3 regulation. Based on these factors, we can roughly represent the starting point for this regulatory framework as follows — noting that the final scope and application of any regulation will depend on specific facts and circumstances…”

Read the full article here by @BrianQuintenz.

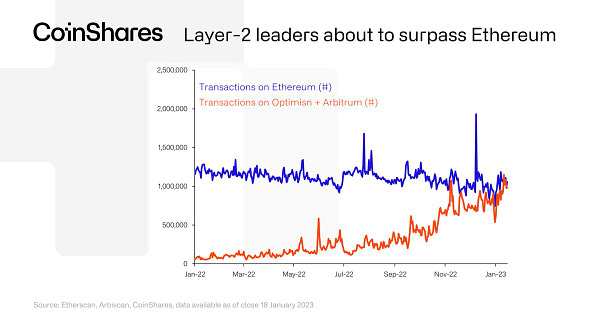

2. Productive Fees: Valuable Protocols / Extractive Fees: Valuable Companies

“…Commoditizing a complementary product in order to bootstrap a protocol is a good playbook at the outset. The most succesful DeFi protocols like Uniswap and Compound gave away their products for free, to help kick off the network effects of the underlying protocol. But this model can't last without protocol subsidies to fund the product. I've come around to the view that mid to long term, this approach is suboptimal because it is too bureaucratic. Instead, an optimal equilibrium may be 1) protocols sustain themselves through "productive fees" that make the the protocol better, faster, stronger such that products want to build on top, and 2) product teams charge "extractive fees" that capture the value they create for end-users. Tying this thread to another, I think there's an argument that the more products built on top of a protocol, the more likely protocol DAOs will be able to charge "productive fees." Lets use Uniswap as an example, which has a rich ecosystem of apps on top driving demand to the protocol, many of which do extract their own fee (e.g. Metamask,) In aggregate, that demand helps keep Uniswap's monopoly on supply in tact, as there are strong network effects to LPing where the demand is routed. Today, Uniswap has a simple fee switch, which may actually diminish the supply-side network effect. But if Uniswap were to update its tokeneconomic model as described in the hypothetical model above, it could help reinforce a strong moat on supply and keep the flywheel between products and protocol spinning...”

Read the full article here by @jessewldn.

undiscovered products³

Discove → create and discover feeds created by the community. It’s dune for feeds.

Webacy → make self-custody secure and easy. No keys or seed phrases needed.

ORB → DESO iOS app where you have ownership of your identity & content.

Find these and all 400+ other resources on intoweb3.land ↗.

☞ support support support ☜

If you liked this newsletter, why not forward a friend?

intoweb3.land is curated by Julian Paul.

See you around.